Fascination About Matthew J. Previte Cpa Pc

The IRS can take up to two years to accept or reject your Deal in Compromise. An attorney is important in these scenarios.

Tax regulations and codes, whether at the state or federal degree, are also made complex for the majority of laypeople and they change frequently for lots of tax experts to stay on top of. Whether you just need somebody to help you with your company income taxes or you have been billed with tax obligation scams, hire a tax obligation lawyer to aid you out.

How Matthew J. Previte Cpa Pc can Save You Time, Stress, and Money.

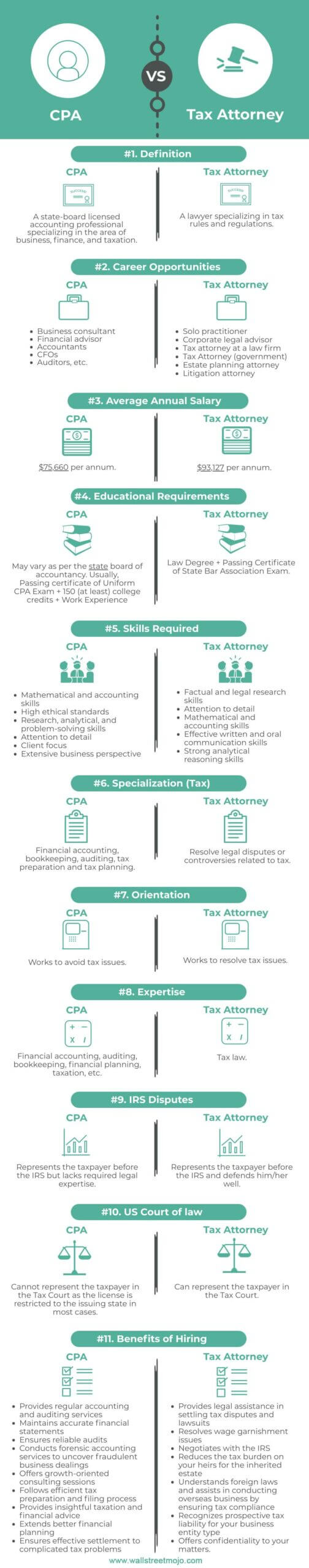

Everyone else not just disapproval handling tax obligations, but they can be outright afraid of the tax companies, not without factor. There are a couple of inquiries that are constantly on the minds of those that are handling tax obligation problems, consisting of whether to employ a tax attorney or a CERTIFIED PUBLIC ACCOUNTANT, when to work with a tax lawyer, and We want to assist address those inquiries below, so you know what to do if you locate on your own in a "taxing" circumstance.

A lawyer can stand for clients prior to the internal revenue service for audits, collections and appeals but so can a CPA. The huge distinction right here and one you require to remember is that a tax lawyer can give attorney-client opportunity, suggesting your tax obligation legal representative is excluded from being compelled to testify against you in a law court.

Everything about Matthew J. Previte Cpa Pc

Or else, a certified public accountant can indicate versus you even while benefiting you. Tax attorneys are much more accustomed to the various tax negotiation programs than a lot of CPAs and understand exactly how to choose the most effective program for your instance and how to get you gotten that program. If you are having an issue with the internal revenue service or simply concerns and issues, you require to hire a tax lawyer.

Tax Court Are under investigation for tax fraudulence or tax obligation evasion Are under criminal investigation by the IRS An additional important time to work with a tax obligation attorney is when you obtain an audit notice from the website link IRS - Unpaid Taxes in Framingham, Massachusetts. https://sitereport.netcraft.com/?url=https://www.taxproblemsrus.com. A lawyer can connect with the internal revenue service in your place, be present during audits, help negotiate settlements, and keep you from overpaying as a result of the audit

Component of a tax obligation attorney's duty is to keep up with it, so you are secured. Ask around for a skilled tax obligation attorney and examine the web for client/customer reviews.

Unknown Facts About Matthew J. Previte Cpa Pc

The tax obligation lawyer you have in mind has all of the appropriate qualifications and testimonies. Should you employ this tax obligation lawyer?

The decision to hire an IRS attorney is one that must not be ignored. Lawyers can be incredibly cost-prohibitive and complicate issues needlessly when they can be resolved relatively easily. As a whole, I am a huge supporter of self-help lawful remedies, especially given the selection of informational product that can be found online (including much of what I have actually released on the topic of taxes).

Fascination About Matthew J. Previte Cpa Pc

Right here is a fast checklist of the matters that I think that an Internal revenue service attorney need to be hired for. Offender costs and criminal examinations can destroy lives and lug very major consequences.

Wrongdoer charges can likewise lug extra civil fines (well past what is typical for civil tax obligation issues). These are just some examples of the damages that even just a criminal fee can bring (whether a successful conviction is eventually gotten). My point is that when anything potentially criminal emerges, also if you are just a prospective witness to the issue, you need a skilled internal revenue service lawyer to represent your rate of interests versus the prosecuting firm.

Some may quit short of nothing to acquire a sentence. This is one instance where you always need an IRS attorney watching your back. There are numerous parts of an internal revenue service attorney's job that are seemingly routine. Many collection issues are handled in roughly similarly (also though each taxpayer's circumstances and goals are different).

The 10-Minute Rule for Matthew J. Previte Cpa Pc

Where we make our stripes however is on technical tax matters, which placed our full ability to the test. What is a technological tax obligation issue? That is a tough concern to address, yet the most effective means I would certainly describe it are issues that call for the specialist judgment of an internal revenue service attorney to settle properly.

Anything that has this "fact dependency" as I would certainly call it, you are going to want to generate a lawyer to speak with - IRS Levies in Framingham, Massachusetts. Even if you do not maintain the solutions of that attorney, an experienced viewpoint when dealing with technical tax obligation issues can go a long method toward recognizing issues and solving them in a proper manner

Comments on “The 15-Second Trick For Matthew J. Previte Cpa Pc”